Resilience Starts Here: Critical Illness Insurance for a Stronger Recovery

A serious illness can change everything—your health, your finances, your future. Critical Illness Insurance helps you stay in control when life takes a turn and helps you bounce back stronger.

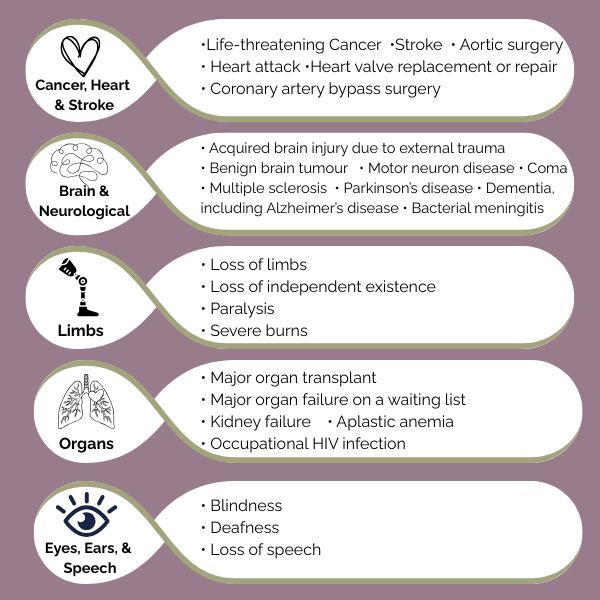

In Canada, the following 26 illnesses are typically covered by Critical Illness Insurance.

[The list may vary from one insurance company to another. It’s also important to note that each illness has a criteria/definition to qualify for full payout through your Critical Illness coverage.]

The Risks

- Nearly 1 in 2 Canadians will develop cancer in their lifetime. ¹

- Cancer, heart attack, and stroke account for the majority of critical illness insurance claims.2

- A diagnosis like cancer, heart attack, or stroke can lead to months of recovery and thousands in expenses. 3

- Even with health coverage, out-of-pocket costs and lost income can be overwhelming.4

- The financial impact may force you to dip into long term savings. 5

- Financial stress can delay treatment, impact recovery, and take its toll on your family. 6

The Benefits

- Lump-Sum Payout – Receive a tax-free cash benefit upon diagnosis of a covered illness — such as cancer, heart attack, or stroke.

- Use the money however you choose — medical bills, mortgage payments, hire homecare, travel for treatment, or simply taking time off work to recover.

- Protect Your Savings – Avoid dipping into retirement funds or emergency savings. The insurance benefit helps cover unexpected costs so you can focus on healing without financial stress.

- Stress-Free Recovery – Financial support during a health crisis can reduce stress and improve recovery outcomes. You’ll have peace of mind knowing your expenses are covered while you prioritize your health.

- Return of Premium Option – If you stay healthy and never make a claim, some policies allow you to cancel after 15 years and receive 100% of your premiums back—a unique feature that rewards wellness and offers long-term value.

- Virtual Healthcare Access – Some plans include 24/7 virtual healthcare, offering quick access to doctors, prescriptions, and medical second opinions.

- Flexible Coverage Options – Choose from term options (e.g., 10 years or to age 75), coverage amounts, and add-ons benefits like partial payout for early detection and non-life threatening conditions, or savings by bundling coverage with life insurance.

- Peace of mind knowing you’re protected when it matters most.

Let’s Talk About Your Protection

Whether you’re planning for your family, your future, or your peace of mind—we’re here to help.

Fill out the form below and take the first step toward simple, powerful protection.

SOURCE¹: Canadian Cancer Society – Canadian Cancer Statistics 2023

SOURCE2: Canada Life Internal Reports 2023

SOURCE3: National Library of Medicine 2021

SOURCE4: Canadian Cancer Society – Canadian Cancer Statistics 2024

SOURCE5: Investing Executive 2002

SOURCE6: National Library of Medicine 2018